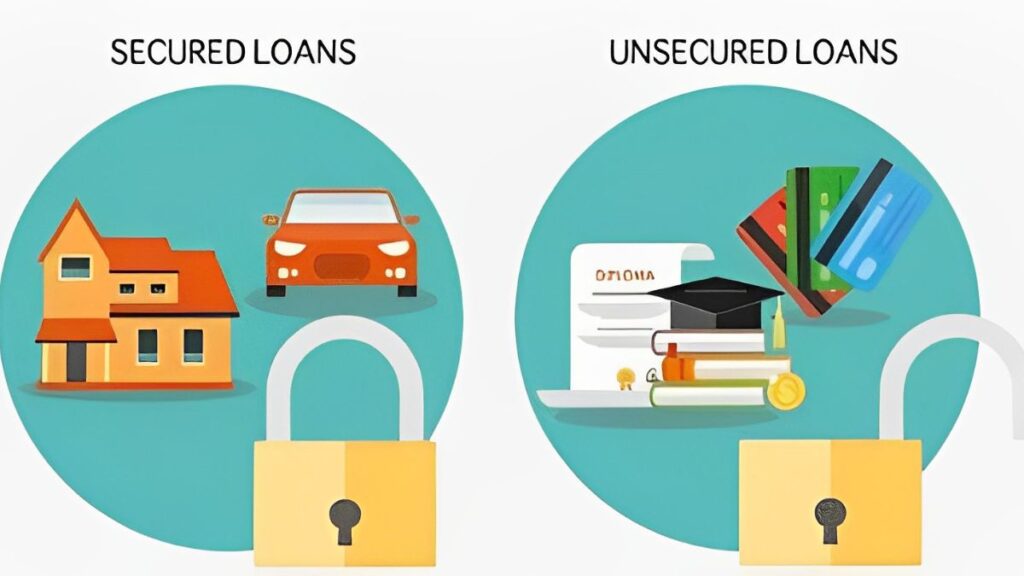

Small business loans are available in a variety of formats, giving businesses across all industries alternative possibilities. Bank loans can be divided into secured and unsecured loans, despite the fact that there are widely different varieties. Collateral is one of the key elements that determine whether such a loan is classified as secured or unsecured. Both Secured and Unsecured Business Loans are different. We have to understand it before taking any loan.

Collateral is a term used to describe the resources that are supplied to secure the mortgage, such as priceless applicant-owned property. If the lender is unable to repay the loan, the collateral might be used to take the asset. It’s crucial to comprehend the distinctions between Secured and Unsecured Business Loans, financing options and how they operate because getting a business loan accepted can effectively put property at risk.

Main Points To Distinguish Between Secured and Unsecured Commercial Loans

- An asset such as a personal or business asset must be used as collateral for a secured commercial loan in order to protect the lender.

- Lenders may want a surety in place of collateral for an unsecured commercial loan.

- Despite the other differences in the criteria, interest rates, and periods, the use of collateral is the primary distinction between such a secured commercial loan and an unsecured commercial loan.

What Sets Secured and Unsecured Company Loans?

The usage of collateral is the primary distinction between Secured and Unsecured Company Loans. Lenders are typically more tolerant of terms and conditions for secured company loans since they are guaranteed; unsecured company loans have had more restrictions since they’re not backed by collateral.

Collateral Conditions for Giving Enterprise Loans

A secured enterprise loan is one that is “secured” with property, hence the name. This means that, in the event that it is unable to fulfill the payments, the business must offer real estate as a guarantee. In contrast, there is no need for collateral for an unsecured enterprise loan. Assets of the company,such as real estate, supplies, and machinery, are examples of collateral.

Credit Rating for Giving Commercial Loans

In general, lenders will run a credit check irrespective of their specifications; however, secured commercial loans offer flexibility with those specifications. Since an unsecured commercial loan is more dependent on the data in the credit file for approval, the requirements will be more stringent. Your personal or corporate credit may be checked, occasionally even both.

Note

Paying off debts is essential to building credit because the amount you owe influences almost one-third of your credit score. Maintaining a credit usage of 30% or below will help you raise your credit score and, eventually, increase your likelihood of being approved for loans.

Interest Rates for Business Loans

Because the lender doesn’t view secured business loans as dangerous, they have lower interest rates. Due to the lack of a guarantee, unsecured business loans often have higher interest rates. Due to the decreased risk, secured loans also offer additional advantageous characteristics like longer payback terms and the capacity to borrow large sums.

Individual Warranty for Company Loans

Another method for approving a bank loan is a personal guarantee, which may be necessary for unsecured company loans. It is a guarantee made by the person asking for the company loan that, if necessary, personal assets will be used to repay the debt. This exposes the person’s assets to risk and makes them personally responsible for debt repayment.

Which Loan is Best for Your Company: Secured or Unsecured?

It all comes down to your company’s requirements and whether you meet the lender’s requirements when choosing a loan for your company. Secured loans can aid startup companies that require the money to pay for operating expenses.

Note

You should decide if borrowing the money is worthwhile, given the cost of additional interest and the use of collateral. Because lenders are more likely to approve secured loans because they know their money is guaranteed, they are an excellent choice for people with bad credit.

If you have good credit or otherwise fit the lender’s criteria, you should consider an unsecured loan. For business owners without collateral, an unprotected business loan might be the best choice for those who prefer not to use their property as loan collateral. Unsecured business loans typically have more complicated terms and tougher criteria and could need a personal guarantee.

Examples of Secured and Unsecured Business Loans

Depending on how long your company has been in operation and how much revenue it generates, you might need to weigh all of your options. For instance, a young company is unlikely to be approved for an unsecured company loan because such loans typically have conditions regarding the duration of the operation. This also holds true for new companies that haven’t generated enough income. As a startup, you could initially only be eligible for a secured company loan; however, as your company expands, you can strive toward becoming eligible for an unsecured company loan.

Note

Make sure to do your homework before applying for a new loan. Depending on your tastes, you might be able to discover advantageous conditions with various loan kinds or alternative lenders who won’t demand that you be in operation for a specific amount of time or have a certain level of revenue.

Conclusion

You’ll probably have to choose between an unsecured loan and a secured loan when you need to borrow money. What’s the distinction? Here’s an explanation of the differences between secured and unsecured loans, as well as some credit counseling advice.

A secured loan refers to one that is backed by collateral, which might be a valuable asset like a house or automobile. In the event that you default on a secured loan, your borrower has the right to seize the collateral. The most popular secured loans are a mortgage and a car loan.

No collateral is used to secure an unsecured loan. Your property cannot be automatically taken by the lender if you fall behind on a loan. Credit cards are the most popular unsecured loan forms.

For more insights and ideas related to businesses, marketing, social media, financial awareness, business essentials and technology check out BiznessHub, to explore further opportunities and knowledge.

FAQs

Ques. Are the majority of loans for small businesses secured or unsecured?

Ans. As financial lenders seek to reduce risks, the majority of loans for small businesses are secured in some way, whether it be with assets or a personal guarantee. Unsecured solutions are available from some institutions, although they tend to be more difficult to qualify for. Since secured loans are offered by both institutions and alternative lenders, there are typically more possibilities for them.

Ques. How can I apply for a company loan, secured or unsecured?

Ans. Both secured and unsecured business loans can be applied for using a similar procedure. Both typically need filling out an application that includes documentation such as proof of identity, contact information, personal and financial information, a credit history, and business plans or other paperwork. Additional information on the collateral will be needed for the secured loan; not so, for the unsecured loan may need additional financial records and paperwork to support the business’s value.

Ques. Can I acquire a loan to operate a franchise store that is unsecured?

Ans. Many personal loans will have more stringent eligibility criteria, like income and credit score limitations. Those who have previously established businesses and are merely growing might, however, be eligible with ease. There are other tailored loans available for starting firms, like funding for real estate.

Ques. How much does the typical unsecured business loan interest rate cost?

Ans. The financial health of the company and other variables, such as credit, affect the interest rates for financing options. Some alternate lenders can offer loans at 100%, while some company loans offer interest rates as low as 2%. Remember that unattended Due to their typically higher interest rates, loans could be on the higher end.